Why do you ought to know about Big Data if you are an entrepreneur

It hasn’t been that long since words like Big Data, Smart Data and Analytics entered our vocabulary. Since we will be using them more and more in the business world, it would be useful to know what they mean as words, and what they mean to you as an entrepreneur.

Big Data

In Big Data, “Big” is used in the sense “numerous” data. Lately, we’ve been hearing or reading about Bid Data more and more. In reality, however, they exist since the 1960s, i.e. when the creation of the Internet commenced, the first data centers were established and various databases started being developed.

Twenty-five years ago, data were increasing by 100GB per day. Nowadays, they are increasing by 50,000GB (50TB) per second.

At this very moment, every minute, 187 million emails are sent, 18 million messages, 2.4 million snaps, 3.7 Google searches take place and 973,000 Facebook logins are performed.

With each passing day, data are not only more than the previous one, they are increasing at a larger rate.

What exactly is Big Data, though?

First of all, there isn’t a specific number above which data are classified as “big”.

Bid Data are datasets that are so large or complicated that cannot be processed using traditional methods. The challenges related to these datasets include the difficulty to collect, store, analyze, search, share, transfer, display data, while they also include information privacy and data sources.

Big Data were initially associated with three key concepts: Volume, Velocity and Variety.

Volume: Businesses and organizations collect their data from various different sources, including business transactions, social media and other information obtained from sensors or data originating from machine to machine (M2M) communication. A short while ago, storing large volumes of data was an issue, however, technology and innovation are addressing this need successfully nowadays.

Velocity: The rate at which data are produced, stored and processed. Data flow at high speeds and must be dealt with timely. RFID tags, Points of Sale of retail shops, sensors and smart meters can deal with a stream of data in almost real time.

Variety: Data are not just numbers and words. There are various different types of data, such as structured, numeric data in traditional databases and unstructured text documents. Examples of such are emails, various media such as video or sound, even data taken from national land registers or various financial transactions, such as credit cards or loans.

The importance of Big Data

The major importance of Big Data lies not so much in how much data you have, but what you do with them. That is, to be able to obtain data from any source, analyze them and find the answers you are seeking which will lead to:

- Cost reduction

- Time reduction

- Development of new products

- Optimization of offers

- Smart decision-making

The combination of Big Data and Analytics can enable you to perform business related tasks, such as:

- Determine in real time the root causes of defects, problems and failures.

- Create specific commercial policies at the point of sale based on customers’ purchasing habits.

- Reallocate entire high-risk portfolios in minutes.

- Detect unlawful behavior aiming to harm your business.

From Big Data to Smart Data

As the volume of data increases, the ability of companies to process these data, and therefore utilize them, decreases. Instead of data facilitating making strategic decisions, they make it more difficult.

Smart Data is here to solve precisely this problem. Smart Data is the amalgamation of large volumes of data and data processing with artificial intelligence and machine learning.

Credit risk optimization

By knowing more about your customers, you can focus on collaborations which may prove more rewarding than others, and not spend your time where you should not.

Plan your company’s cash flow

I.e. view your income rate by analyzing historical data and find out if you run a risk of delaying a payment, so that you can plan your expenses accordingly.

You know what it is like to have outstanding debt claims when you need to pay salaries and settle supplier invoices. Through various analysis models, Smart Data provide you with up-to-date financial accounts. Thus, it is easier to make financial plans so that you avoid unnecessary business expenses in the future.

Find the customers you want

Smart Data can provide you with the qualitative characteristics behind a large amount of data. Traditionally, the audience targeting you could perform was very general, resulting in not being able to provide personalized offers. Now, you can see the people behind the numbers; who they are, what their interests are and how they might be interested in your products or services.

Identify the customers that are important for you

We’ve all heard of the 20-80 rule (from the Pareto principle). This rule says that 80% of your sales come from 20% of your customers. To put it simply, some customers offer more to your business than others. However, the question is, who are these customers, how can you identify them and how can you sell them “personalized” products or services? Smart Data contain a series of models to solve this problem. Because, after all, not all customers are the same.

Looking ahead

How likely is it that one of your suppliers will go bankrupt tomorrow? How much will your turnover be tomorrow? What will be your customer’s next purchase? Smart Data can answer these questions for you, so that you can be better prepared for future events and make the right decisions.

Smart Data & Analytics by Cardlink

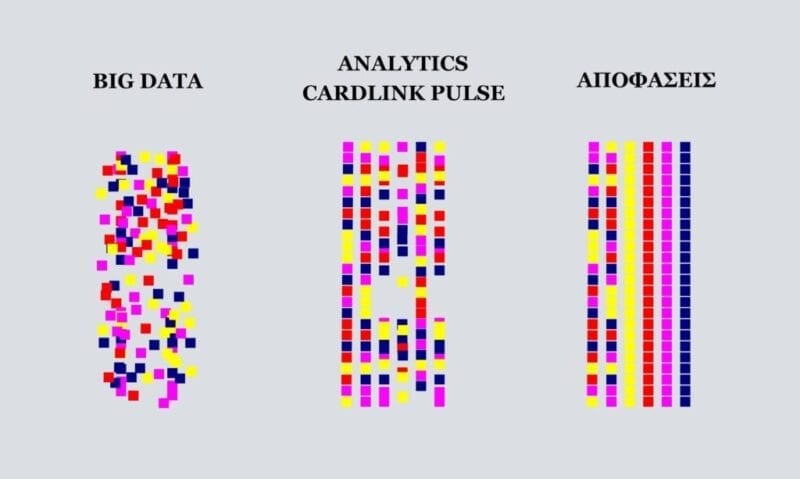

The Analytics of Cardlink pulse are here to convert Big Data to Smart Data.

- Cardlink pulse will enable you to see all the data and numbers that will enhance your business. Thanks to the Smart Data of Cardlink pulse, you can have possibilities and benefits you did not have before:

- By converting numbers into opportunities, you can grow your business.

- You are in a position to evaluate different marketing strategies and adapt them according to their performance.

- By understanding your customers’ consumer behavioral patterns, you can increase your clientèle by finding similar customers to them.

- You can find out more about your customers, from where they live to how much they spend, and thus target your market more effectively.

- Find out your ranking among the competitors and aim for the top.

- Cardlink’s Analytics filter a large amount of data so that they can be useful to you, which will help you make right decisions.

Because data have no value, if we cannot make them valuable.