George Drimiotis at Fortune Greece: Cardlink functions as a bridge that connects businesses with consumers

George Drimiotis: Cardlink functions as a bridge that connects businesses with consumers

Cardlink CEO talks at Fortune Greece on the prospects following Worldline acquisition and the impressive growth outlook of payments in Greece. Vassilis Samourkas

POS is not just a payment tool for businesses. It is a wayout that saved thousands of businesses during capital controls and got established during the pandemic. At a recent study by Printec, we find that in 2020 Greece was the “champion” in POS distribution in Central and Eastern Europe in terms of POS distribution among 14 countries in central and eastern Europe, having a notable increase of 17% from 2018 to 2020. Cardlink has played a vital role in this impressive growth of PayTech in Greece. It is a company that functions as the bridge connecting businesses with consumers building relationships of trust Mr George Drimiotis said.

Changes in the way everyday payments happen brought challenges and created the need for significant investments as the growth outlook in electronic payments is great. Worldline Group, a global leader in payments with 22 bn euros capital, 20.000 employees and presence in more than 50 countries invested in the Greek market, acquiring in May 2021 92.5% of Cardlink at 155 mn euros, with Mr Drimiotis remaining as CEO and shareholder of Cardlink alongside Worldline. Based on the evolution in the payment market, Cardlink CEO talks at Fortune about his company’s plans, the changes and the trends in electronic payments and the most interesting changes regarding the four systemic Greek banks.

What were the main reasons for Worldline to acquire Cardlink and which are the goals you set for the future?

The acquisition took place following an assessment of the company’s options for its further development, which took place by the Quest Group to which the company was part of. Our journey with Quest lasted for almost 7 years and during that time we created a company with great contribution to the development of payments in Greece, significant infrastructure, brilliant people, a strong brand name and a very good financial status. Further development requires significant investments, economies of scale and access to new products and services in order to meet our customers’ requirements and expectations. At the same time, Worldline is a leading company in the world in the field of e-payments (with a capitalization of 22 billion, 20 thousand employees and presence in more than 50 countries) that wanted to enter a developing and attractive market, such as the Greek one. At Worldline, Cardlink found a home that will serve as a boost and an incentive for the next phase of our development.

In terms of goals, not much has really changed. We continue to strive to develop further and achieve our plan, the main financial goal of which is to have a 10% annual increase in revenue for the following years, while of course retaining the leading position in the Greek market. Cardlink has been fully integrated into Worldline’s strategy and is ready to contribute to the ambitious three-year plan presented by the Group in October 2021.

“Electronic transactions contribute to increasing the productivity of both consumers and businesses”.

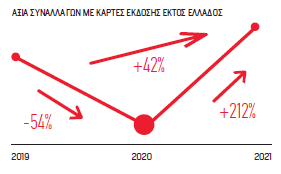

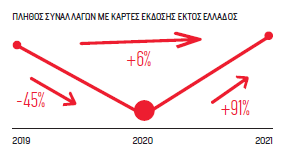

BY THE NUMBERS

When looking at the recent study by Printec, we find that in 2020 Greece was the “champion” in POS distribution in Central and Eastern Europe. How did we reach this position, what does this rapid growth mean for Cardlink and the wider PayTech market and, most importantly, what needs have now arisen and how do you respond to the new trends emerging (wallets, payments via mobiles/wearables, etc.)?

There are three reasons for Greece reaching the top in POS distribution. Firstly, the 2016/2017 legislation on mandatory acceptance of e-payments by businesses, which led companies to install POS terminals. Secondly, Greece’s geography, as its many islands have resulted in areas with a small population having a large POS base installed in order to serve tourists. And thirdly, in Greece the ratio of small businesses to the population is still very large compared to other markets, so there are necessarily more terminals to facilitate transactions.

This first position means that the difficult work of setting up the infrastructure for performing e-payments has already been carried out. The next step is the further use of this infrastructure along with an increase in its use by consumers. We are already witnessing consumers trusting electronic transactions and making e-payments even for small amounts. For example, in the Cardlink network 42% of monthly transactions are under €10. Despite the explosive increase in transactions due to capital controls and the pandemic, there is considerable room for improvement in this area. Today, e-transactions correspond to 25%-30% of consumption, i.e. approximately €30 billion. There is no reason why this percentage shouldn’t rise to 40%-50% of consumption (€50 billion). Technology will contribute significantly to this. The use of mobile phones (in all their forms, including wearables) will be the driving force behind the next wave of development of e-transactions. At Cardlink we are ready to support all changes/innovations and to shape the future of payments. We serve the present, we work for the immediate future and we prepare for the distant future.

“Our purpose is to help businesses grow.”

Cardlink’s acquisition by Worldline was one of the most resounding moves in the PayTech sector in Greece, while at the same time we saw the banking sector making disinvestments in the same area. What is the state of the field of e-transactions in Greece and to what extent can you comment on everything that has been happening recently in the area of card acceptance in Greece?

Developments in Greece have been rapid this year. Within 12 months, all 4 systemic banks have announced the sale or the intention to sell transaction acceptance operations, unlocking capital of the order of € 1.2 billion euro. With capital controls, exiting the financial crisis and the pandemic playing a catalytic role, the Greek market has had significant growth in the last year. Transaction acceptance operations require on the one hand significant investments in technology and know-how for new products and services, and on the other h

and they rely on economies of scale in order to keep the costs down. By selling or through partnering with strategic players, banks manage to both unlock capital and position themselves better in the future so that they can offer their customers high quality services. The Greek market is in the right

place for these moves to take place. It has already had two large waves of growth of transactions (capital controls and the pandemic), but, as mentioned above, it also has significant prospects for further growth. Through its acquisition of Cardlink as well as its recent agreement with Eurobank, Worldline is implementing its expansion strategy by placing itself in the rapidly developing Greek market. From a broader point of view, the arrival of strategic players in Greece will benefit the market by providing further added value through better services, new products and innovation, as well as more reasonable costs for the services offered.

What is your response to the opinion that merchant fees are highly priced in Greece? Is there room for action by the state?

There is a lot of talk about the cost of e-transactions for businesses. The data are overwhelming, however, in this case as well. The average merchant fee for card transactions in Greece is at the same levels as the European averages, and actually with much smaller overall transaction volumes due to the size of the Greek market. At current levels of merchant fees in

Greece, the overall cost of cash management is definitely higher. And it is certain that the cost of e-transactions will decrease further as e-transactions increase, while the cost of cash can only increase. Finally, for businesses e-transactions are also a source of data that can be utilized to improve sales and/or the quality of customer service.

In terms of measures, I think that the state should continue taking measures for the adoption of electronic transactions. There are still business categories that are exempt from the relevant provisions, so this should be regulated at some point. Furthermore, it is necessary to continue to provide incentives to consumers and/or to make the incentives more targeted for transaction categories that have a greater tendency towards tax evasion/avoidance. Financial institutions and the providers need to continue to improve their products and services, making them easier to use.

CARDLINK’S TECHNOLOGY

Cardlink has developed the Android ecosystem by creating the payments app – Cardlink POSsible that works independently from the hardware (hardware agnostic) and is compatible with many different model devices, alternative manufacturers. The same platform can act as a vehicle for a multitude of innovative functions and now the customer has available a solution that is not limited only to payments, but it can enrich its environment with applications that operate either autonomously or in cooperation with our own services by taking advantage of the hardware.

Photos Sylvia Diamanopoulou

Published on Fortune magazine, December 2021/January 2022. You can read it here .